Perpetual Debt Instruments: Latest News, Videos and Photos of Perpetual Debt Instruments | Times of India

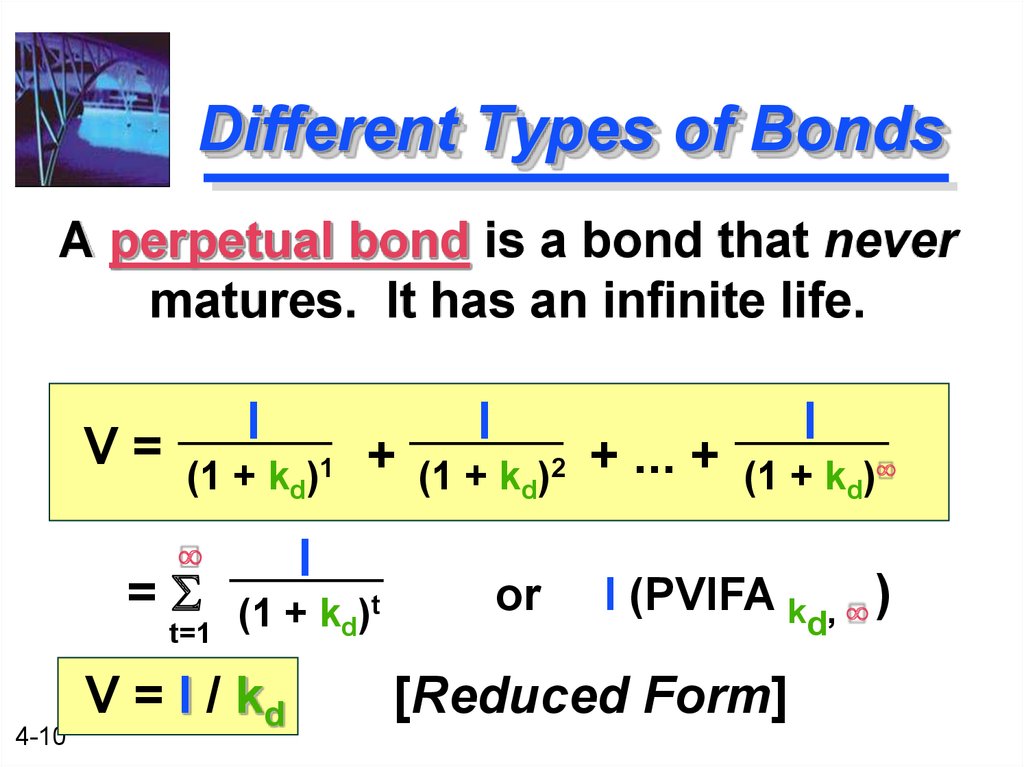

FINANCIAL INSTRUMENTS (PART 1) This Accounting-related series is about discussion of presentation of Financial Instruments to help accounting students... | By Accounting Made Easy | Facebook

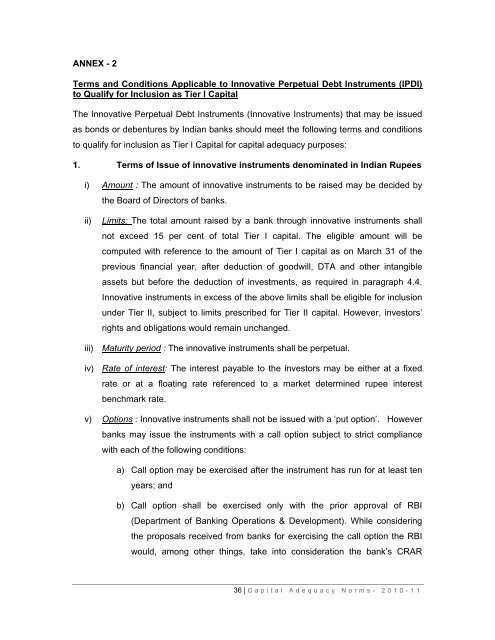

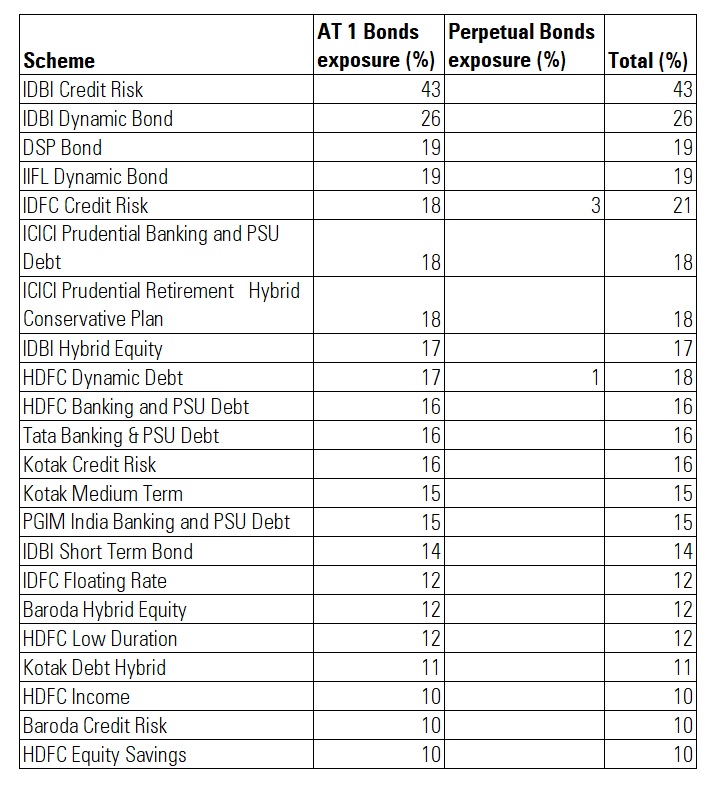

Deepak Shenoy on Twitter: "@Joydeep50663039 @eyeofsiva Lemme put the corresponding one for PDIs (Perpetual debt instruments that qualify for Tier 1) Source: https://t.co/AKjHPpqCPH https://t.co/CEr1O9A1Bl" / Twitter

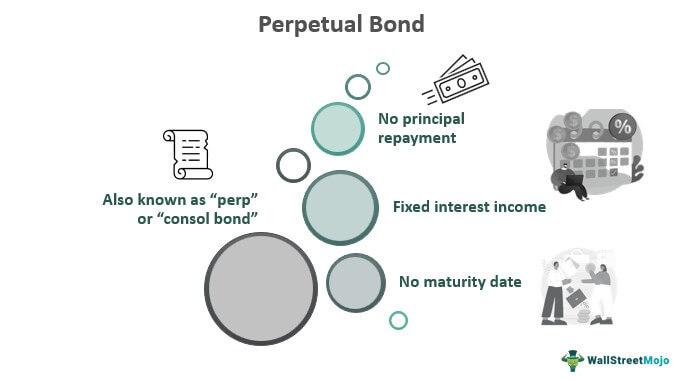

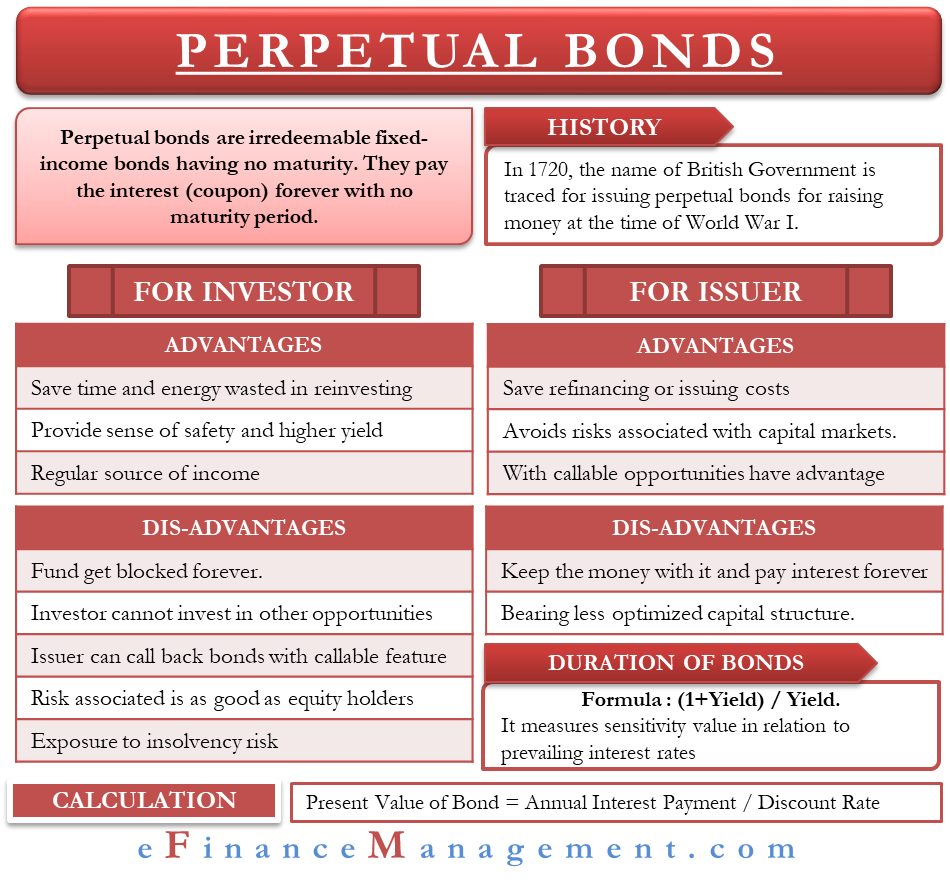

What are Perpetual Debt Instruments?/What are Addl Tier I and Tier II Capital? Features of PDIs. - YouTube