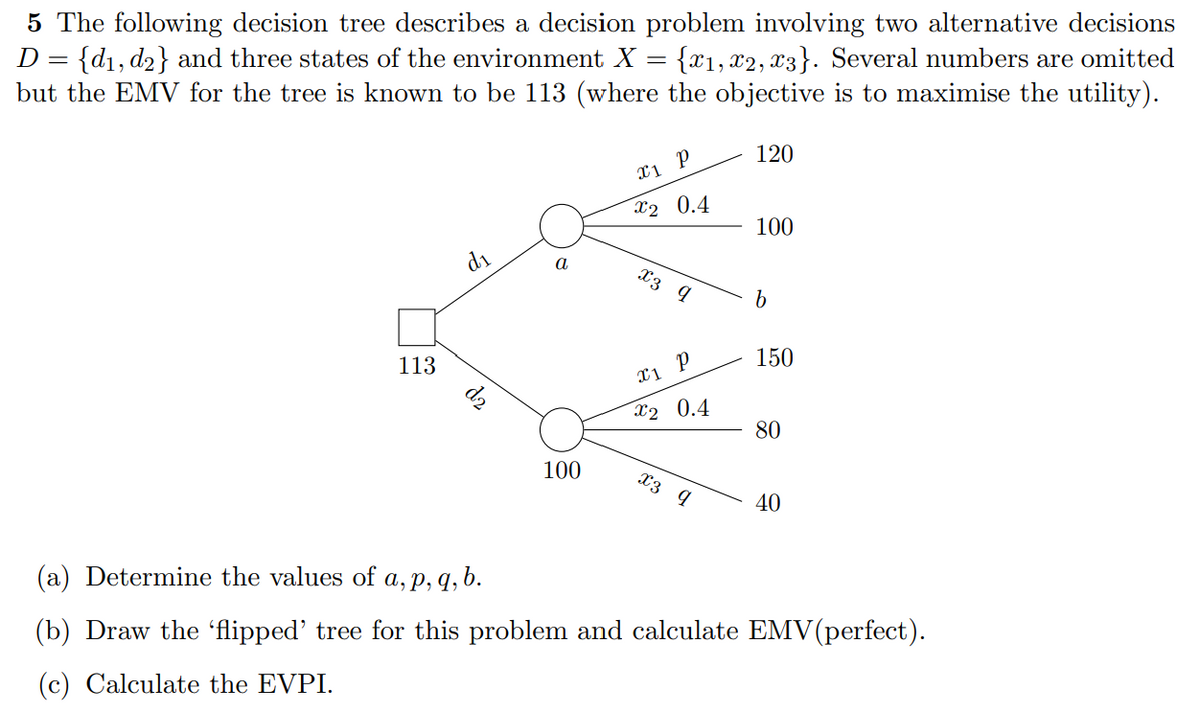

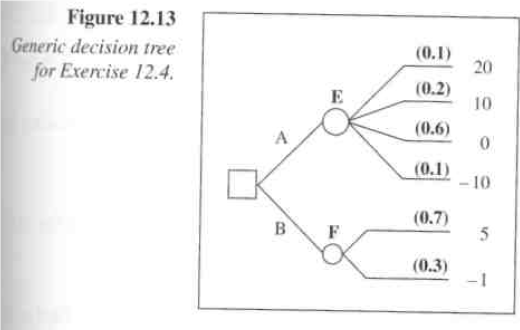

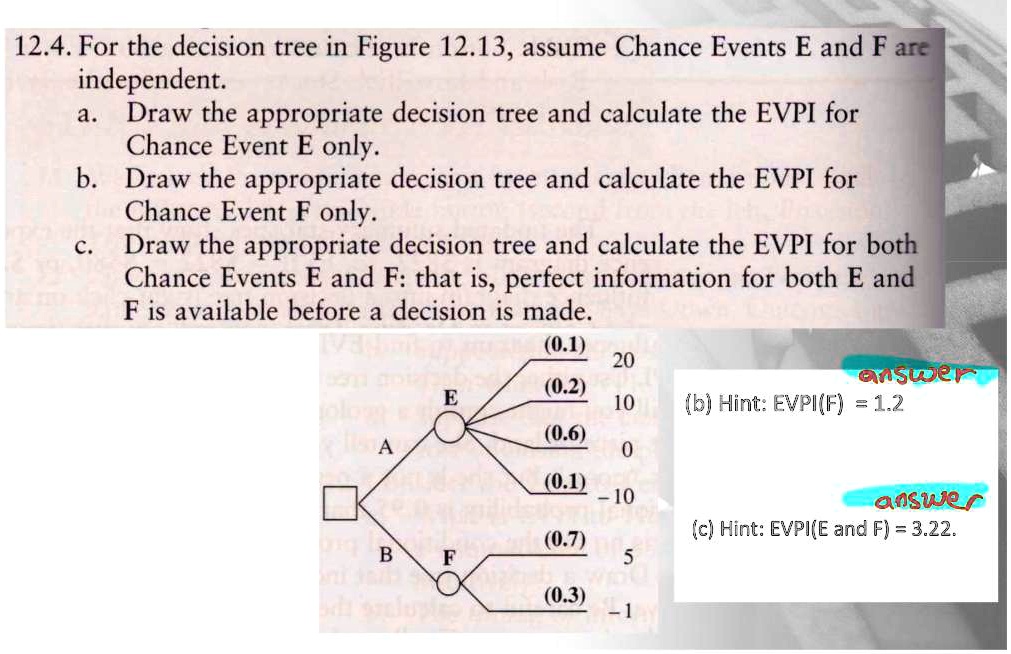

SOLVED: 12.4.For the decision tree in Figure 12.13, assume Chance Events E and F are independent: a. Draw the appropriate decision tree and calculate the EVPI for Chance Event E only. b

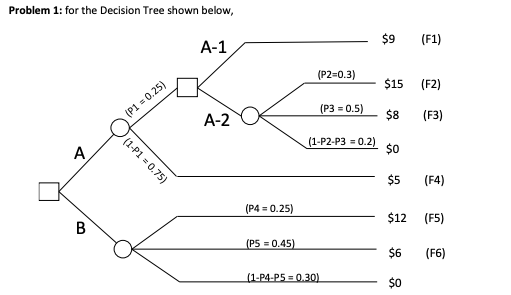

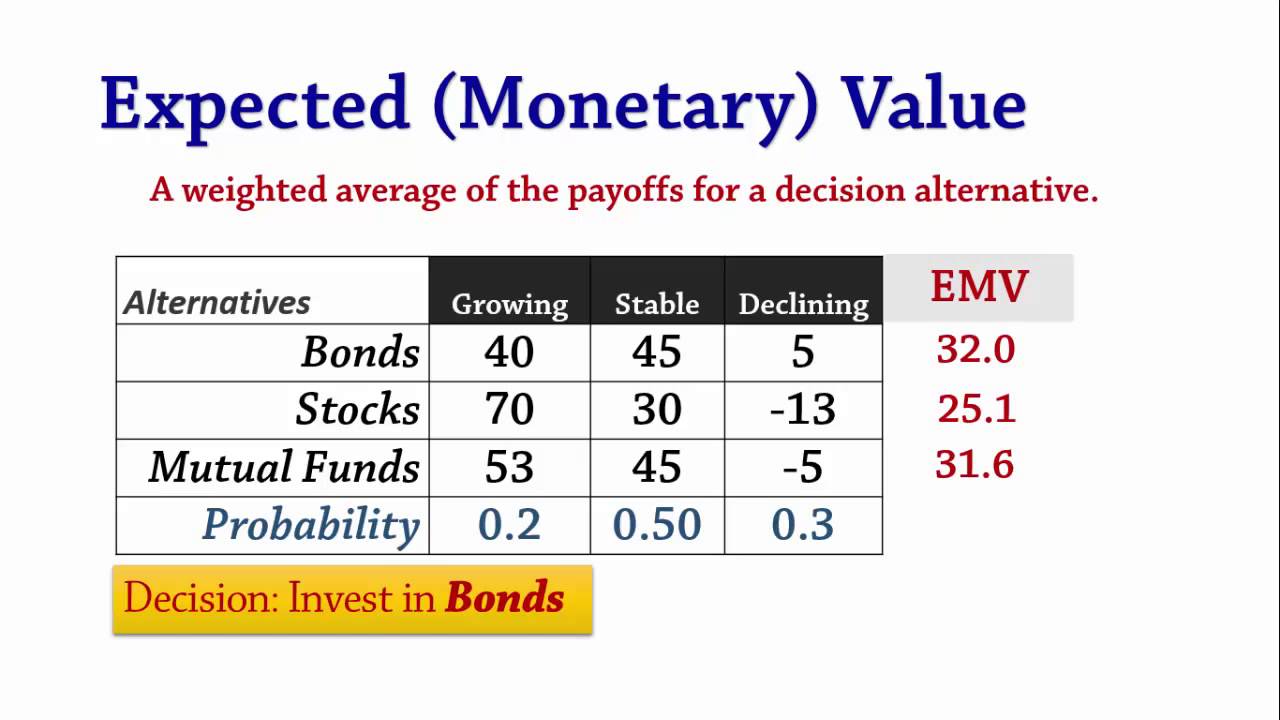

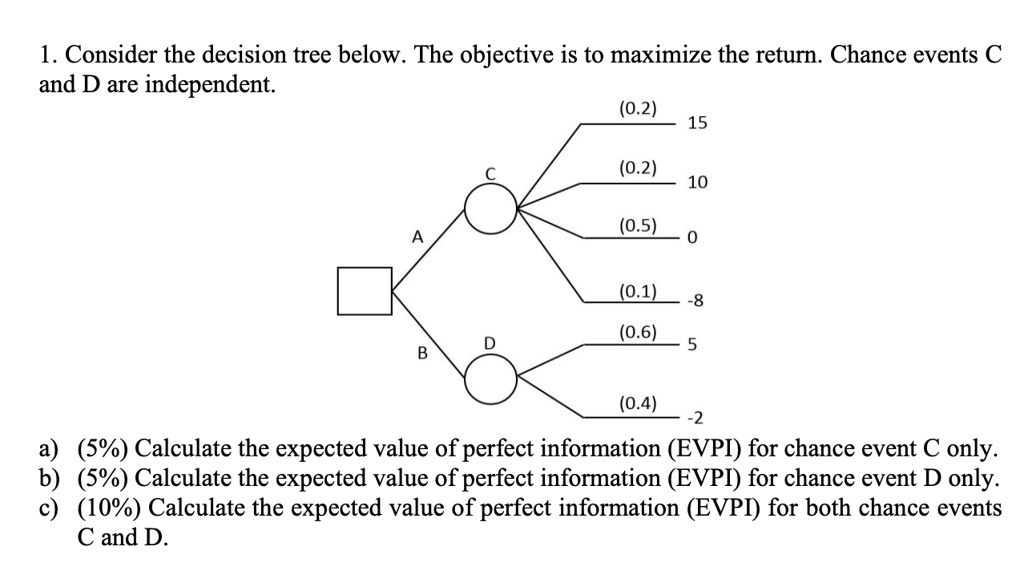

SOLVED: 1. Consider the decision tree below. The objective is to maximize the return. Chance events C and D are independent (0.2) 15 (0.2) 10 (0.5) (0.1) (0.6) (0.4) a) (5%) Calculate

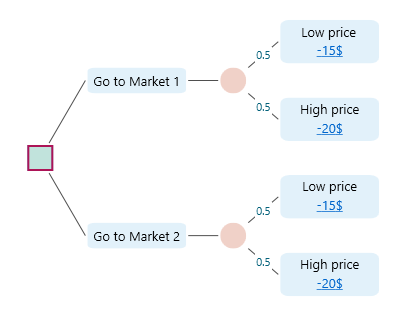

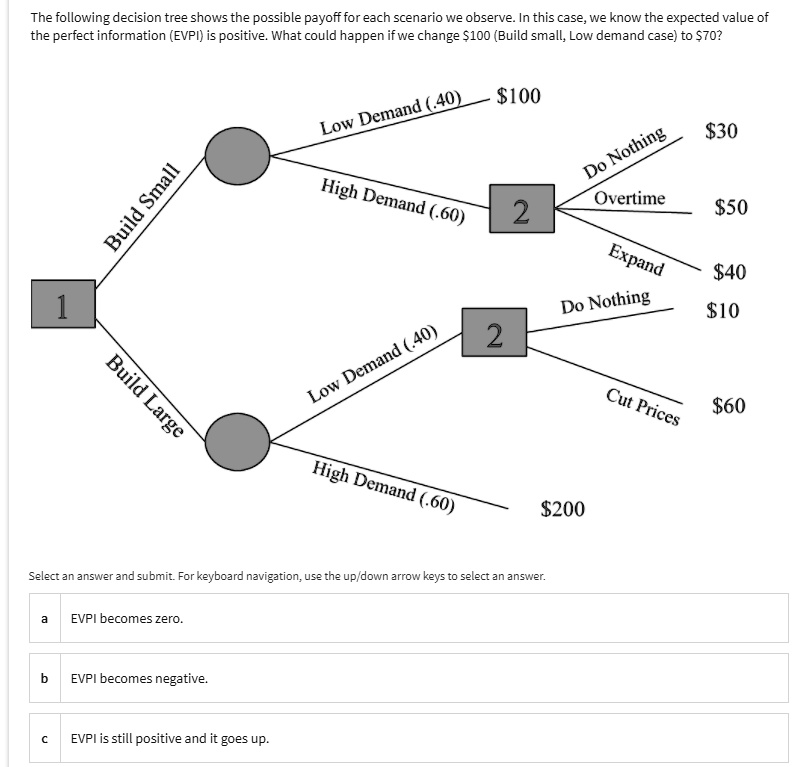

SOLVED: The following decision tree shows the possible payoff for each scenario we observe: In this case; we know the expected value of the perfect information (EVPI) is positive What could happen